Link Your Aadhaar with PAN

A complete guide to linking your documents, checking status, and understanding the process.

Deadline

The deadline has passed. Linking now attracts a late fee. Don't delay further to avoid PAN becoming inoperative.

Fees

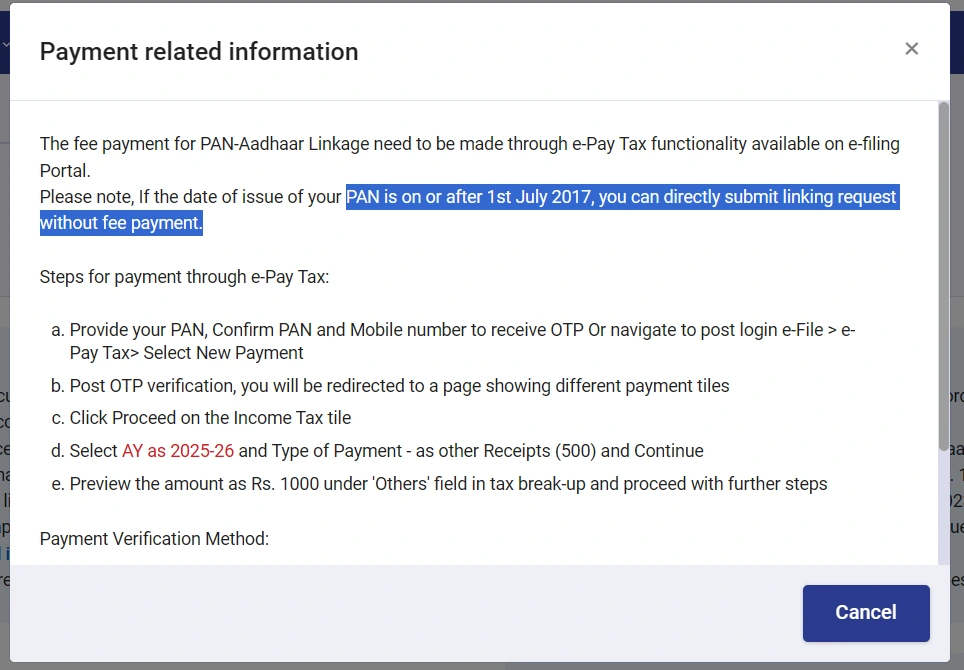

A mandatory late fee of ₹1,000 must be paid via e-Pay Tax before submitting the linking request.

Benefits

Seamless ITR filing, tax refunds, and continued access to banking and financial services.

Why is it Important?

Linking your Permanent Account Number (PAN) with your Aadhaar number is mandatory for all eligible Indian citizens. Failure to do so leads to your PAN becoming inoperative.

- Pending tax refunds and interest will not be issued.

- TDS and TCS will be deducted at a higher rate.

- Inability to invest in mutual funds, stocks, etc.

- Difficulty in opening bank accounts or getting loans.

Step-by-Step Linking Process

Visit the Official Portal

Go to the Income Tax e-Filing portal. Look for the 'Link Aadhaar' option in the Quick Links section.

Enter Details

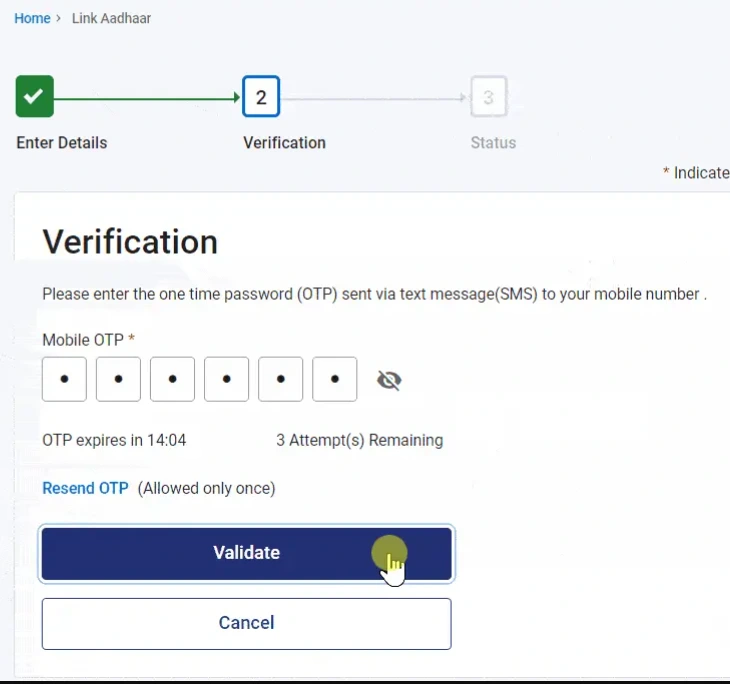

Enter your PAN number and Aadhaar number in the respective fields. Click on 'Validate' to proceed.

Verification

If your PAN and Aadhaar are not linked, you will be asked to continue to pay through e-Pay Tax.

Confirmation

After successful payment and validation, your request for linking will be sent to UIDAI for validation.

Watch the Process

A quick visual guide to understand the linking flow

Loading visual guide...

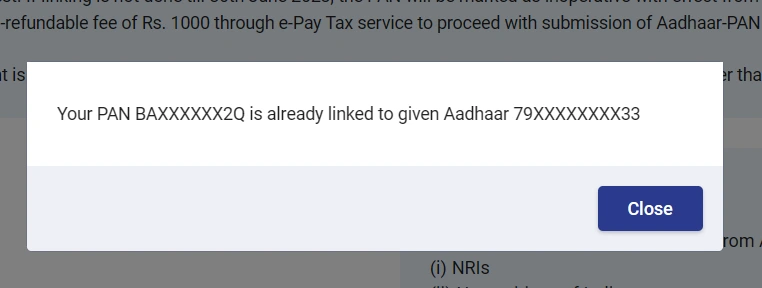

Already Linked?

If you have already completed the process, you can verify your status. You should see a message confirming that your PAN is already linked to the given Aadhaar.

Check Status

Frequently Asked Questions

Ready to Link Your Aadhaar?

Don't wait any longer. Ensure your financial documents are in order and avoid penalties.

Go to Income Tax Portal